Interest Free Credit Garden Furniture

About Klarna

Safe and secure

With Klarna, you are always covered through Klarna’s Buyer Protection policy. Modern safeguards protect your information to prevent unauthorised purchases.

Frequently asked questions

Visit our FAQ page to find out more about using Klarna.

At Klarna, we have a relentless focus on creating the best shopping experience in the world. We believe payments are so much more than just a way to send money. That’s why our smooth checkout options give you more time and control so you can focus on the things you love.

- More than 150 million shoppers are using Klarna.

- 450,000 retailers are working with us worldwide.

- We’re one of Europe’s largest banks and we’ve been powering online checkouts for over 15 years.

Klarna's Pay in 3 are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status.Ts&Cs and late fees apply.

How does Klarna work?

Part 1: How it works

Shop now. Pay later with Klarna.

We’re excited to announce we have partnered with Klarna to bring you new ways to pay at checkout.

Here’s how it works:

Step 1

Add products to your cart and select “Klarna” when you check out

Step 2

Enter a few personal details and you’ll know instantly if you’re approved

Step 3

Klarna will send you an email confirmation and reminders when it’s time to pay and you can manage your orders and payments in the Klarna app.

Part 2: Payments information

[ATTN: Only insert the below payment options that are available on your store]

Pay in 3

Spread the cost of your purchase into 3 interest-free instalments. The first payment is made at point of purchase, with remaining instalments scheduled automatically every 30 days. Select the Klarna option and enter your debit or credit card information.

- A new way to pay that's an alternative to a credit card.

- 3 instalments gives you flexibility to shop without interest.

- Not making your payment on time could affect your ability to use Klarna in the future.

- Debt collection agencies are used as a last resort.

Klarna's Pay in 3 is an unregulated credit agreement. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status.Ts&Cs and late fees apply.

Part 3: About Klarna

Pay online or in the app

Review your latest purchases and make payments in the Klarna app or online.

Download the Klarna | Log in online | Chat with customer service

FAQ about Klarna

We got it covered - we answered frequently asked questions that your customers may have about Klarna before, during or after the purchase. Just choose the Klarna product FAQ below, copy the relevant questions to your site, insert your online store name and applicable terms in the areas in brackets. And done! Please note: if you're offering our financing product, please speak to your Klarna point of contact for customer FAQ.

Pay in 3

Frequently Asked Questions

The following FAQs are provided to merchants offering Klarna’s Pay in 3 to their customers. They should be made easily available on the merchant website to ensure customers understand and have access to additional information regarding this payment method.

Who is Klarna?

Klarna is a payments service that helps you buy the things you want or need. Right now, over 150 million people worldwide use Klarna at over 450,000 online stores.

How does Pay in 3 work?

Klarna’s Pay in 3 is a credit product that lets you spread the cost of your purchases over 3 equal interest-free payments. Klarna will take the payments from your debit or credit card directly so you don't have to worry about missing a payment. Klarna will take the first payment when you make the purchase, the second 30 days later and the final payment 60 days from your purchase date. You can see your past and future payments at any time using the Klarna app.

Am I eligible for Pay in 3?

You need to be at least 18 years old and a UK resident to use Klarna’s credit products including Pay in 3. When you choose Klarna they will also check the information you provide and your financial situation.

Can I have multiple Pay in 3 orders at the same time?

Yes, you can. If you see Klarna Pay in 3 when you go to an online checkout then it is available to you. Every time you use Pay in 3, Klarna will check to see whether you can use Pay in 3 again for each additional purchase.

What does Klarna consider when reviewing my application?

Klarna offers Pay in 3 based on a number of factors such as the purchase amount, and previous order history. You can improve your chances of being offered Pay in 3 by ensuring you provide your full name, accurate address details and arrange shipping to your registered billing address. All orders are assessed individually. Just because you have been accepted for Pay in 3 before does not mean it will be offered for every order. In turn, if your application for Pay in 3 is denied, it does not mean it will be denied for future orders.

What do I need to provide when I make a purchase?

If you want to purchase something using Klarna’s Pay in 3, you'll need to share your phone number, email address, current billing address and your credit or debit card details. If Klarna need to talk to you urgently they'll use the phone number you've shared. For any other information Klarna need to share with you, they'll send this to your email address.

Will a credit search take place?

When you use Pay in 3, Klarna will perform a credit search. This means Klarna will look at certain information in your credit report to decide whether to approve your purchase.

How do I make repayments to Klarna?

Klarna will take your Pay in 3 payments from the debit or credit card you shared when you made your purchase. Klarna will take the first payment when you make your purchase, the second payment after 30 days and the final payment 60 days from the day you made your purchase. You can see both past and future payments using the Klarna app.

Can I pay before the due date?

Yes. Just go to the Klarna app or log onto Klarna.com/uk.

Is my payment information safe?

Payment information is processed securely by Klarna. No card details are transferred to or held by featureDECO. All transactions take place through connections secured with the latest industry standard security protocols.

How do I know Klarna has received my payment?

Klarna will notify you by email, SMS or push notification when a payment is due and when you have made or missed a payment. You can always check the status of your order and payments in the Klarna app or by logging in at www.klarna.com/uk.

What happens if I don’t make a payment on time?

Pay in 3 is a credit product and you are required to make your scheduled payments to Klarna. Your payments are automatically withdrawn from your connected card or bank account according to the agreed payment schedule. Klarna will send you multiple friendly reminders before payment is due so you can make sure you’ve got enough money to pay. If payment fails, you may be charged a late fee, subject to our T&Cs.

What happens if I don’t pay for my order?

If you don't make your payments you will be in arrears as Pay in 3 is a credit product. Klarna may then share information about your missed payments with credit reference agencies. This means you may find it difficult or more expensive to use Klarna or other lenders' credit products in the future. Klarna may also refer any debt to a debt collection agency. This agency will collect the debt on behalf of Klarna. Also, if the debt is referred to a debt collection agency Klarna will share this information with credit reference agencies.

I've received a statement, but I've not yet received my goods.

If you have not received your goods please call featureDECO to check on your order and delivery status. You can also contact Klarna’s Customer Service so that they can postpone the due date on your payment or put the order on hold in the Klarna app while you wait for the goods to arrive.

What happens if I cancel or return my order?

As soon as featureDECO has confirmed with Klarna that your cancelation / return has been accepted, Klarna will cancel any future scheduled payments as well as refund any amounts due. You will see the return in the Klarna app immediately.

I have canceled my order. How long will it take until I receive my refund?

As soon as the store has registered your cancelation or your return, the refund will normally be processed within 5 business days.

I have asked for a refund. How will I be refunded?

Refunds will be issued back to the debit or credit card which was originally used at checkout.

What happens to my statement, when I have returned the goods?

Once featureDECO has received the return and Klarna have received our confirmation, Klarna shall refund any payments collected and cancel any future scheduled payments. You are always able to monitor the status of your order in the Klarna app.

What happens to my statement when I have returned part of my order?

Once featureDECO has received the partial return and Klarna have received our confirmation, an updated statement with an adjusted payment schedule will be sent to you by Klarna. You are always able to monitor the status of your order in the Klarna app.

I haven’t received an email with my statement/payment information.

You can log in the Klarna app or at www.klarna.com/uk, where you will find all of your orders and payment schedule information.

I still have questions regarding payment, how can I get in touch?

Visit Klarna app Klarna’s Customer Service page for a full list of FAQs, live chat and telephone options.

Klarna's Pay in 3 are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

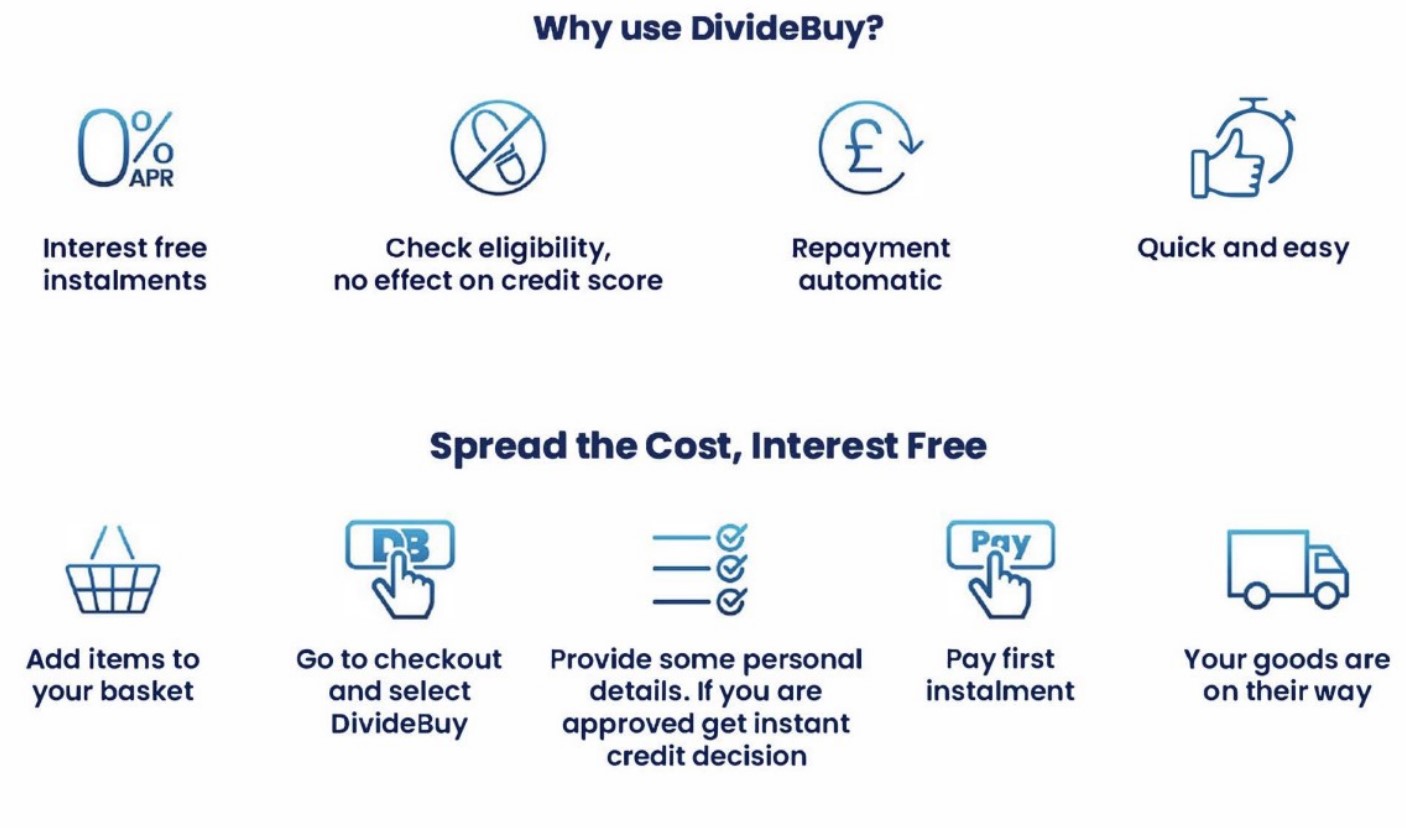

Interest-Free Finance - No interest, only a 10% deposit (Deposit payable only after the finance is agreed) - Available on orders over £800

Spread payments over a deposit and 6 monthly installments instead of paying in one lump sum. The deposit is payable and the finance application is processed, and then the first installment is payable 30 thirty days after dispatch. For details and an outline of the payment plan, simply proceed through the checkout as normal and select "6 Months or 9 months Interest-Free Credit" as your payment method.

Pre-orders: For pre-orders, the 10% deposit is taken when the order is placed and the finance application is processed before dispatch.

Additional fees may be applicable for any missed payments. PLEASE NOTE: WE CANNOT DISPATCH ORDERS ON SPECIAL DELIVERY SERVICES SUCH AS EXPRESS DELIVERY DUE TO THE ADDITIONAL PROCESSING TIME OF 1-2 WORKING DAYS PER APPLICATION BEFORE DISPATCH. IF YOU REQUIRE THE PRODUCT SOONER, PLEASE KINDLY PAY BY CREDIT CARD OR DEBIT CARD.

FAQ's

Are there limits on how much I can spend?

DivideBuy interest-free credit is available on products/services from £800 to £6000. Credit is available from 6 to 9 months. The credit offered is set by the retailer.

My application was declined. Now what?

We’re sorry that your application was declined. Unfortunately, we do not influence the credit decision and we’re unable to find out why your application was denied. DivideBuy is not permitted to share application information with us.

Who can I contact if I need help?

For any questions related to DivideBuy interest-free credit please contact DivideBuy by visiting www.dividebuy.co.uk. For a full list of FAQs please click here.

Are there any fees or charges?

No. There are no APR or hidden charges. We do reserve the right to add late payment fees to your account in the event of you missing payments. This is all explained in your credit agreement before you electronically sign at the checkout process.

How can I manage my DivideBuy account?

To manage your account, and make payments you can log in https://accounts.dividebuy.co.uk/

Will a credit check be performed?

Yes. A credit check is performed to assess your eligibility and affordability. DivideBuy also has a quick check service so you can assess your eligibility for DivideBuy credit that will not affect your credit file.

How do I make my monthly payments?

Payment is collected via a Continuous Payment Authority (CPA). This method uses your long card number, expiry date and three-digit CV2. Payments will be collected automatically on the date your installment is due.

What if I would like to cancel/ return my order?

The first step is to contact the retailer directly to cancel your order. If you have already received your order, you’ll need to arrange for it to be returned using the retailer’s returns process. The retailer will then contact us to confirm your order has been returned, so we can issue a refund and cancel your credit agreement.

Can I request delivery to an address other than my home address?

To guard against fraudulent applications, we are only able to deliver goods to your home address.

What if I need to change my delivery address from my billing address?

DivideBuy will need to approve any deliveries to addresses other than the application/billing address. Without their approval, we will not be able to ship to a different address as fraud prevention measures apply. To have goods delivered to another address, once you have placed your order and paid a first instalment, you need to contact DivideBuy directly who will then notify us of the changes.

Who can apply for DivideBuy interest free credit?

• Applicants must be aged between 18 and 75

• Be a permanent UK resident

• Have a valid debit or credit card

• Have a valid UK mobile number

• Have a valid email address

Interest-Free Finance - No interest, only a 10% deposit (Deposit payable only after the finance is agreed) - Available on orders over £1500

To apply for interest-free finance, simply follow these 3 steps:

(1) Add item(s) to your shopping basket, then checkout as normal.

(2) Select the "6 Months Interest-Free Credit" option as your payment method.

(3) You will shortly receive an email with a link to apply through V12 Finance. If the order is placed outside business hours, then you will receive the link as soon as the office re-opens on the following working day. From there, the application process is simple and takes just a few minutes. You will receive an instant decision, along with instructions regarding paying the deposit and your installment plan.

Who is eligible for 0% Credit?

To apply for credit with V12 Finance, you must:

- be at least 18 years old.

- have been a UK resident for 3 years or more

- be able to make repayments by direct debit

- be in full-time employment, self-employed, or retired over 50

If you have any issues, please give us a call at 01922 214 994 or email us at enquiries@featuredeco.co.uk and we will be happy to assist.

What do I do if my application has been declined?

There are various reasons your application might have been declined, and if this is the case, then simply give us a call to let us know if you can arrange an alternative payment method such as a debit or credit card. If you wish to appeal an unsuccessful application for credit, you can contact V12 Finance directly at 029 2046 8900, and they will assist you.